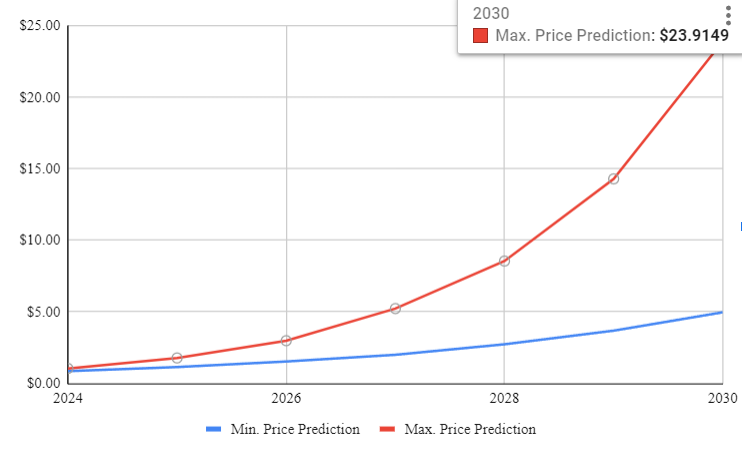

Our prediction for Ripple price 2024-2030

Our analysts are optimistic that Ripple will see a maximum price of $23.9149 by 2030. To help you gauge the returns on Ripple, we offer a thorough guide detailing its price expectations from 2024 to 2030.

What is XRP crypto?

Ripple, often referred to as XRP, is a digital currency and payment protocol created in 2012 by Ripple Labs Inc. Its primary goal is to transform cross-border transactions, making them faster, cheaper, and more secure.

Key Features of Ripple

Digital Currency: XRP is the native cryptocurrency of the Ripple network, facilitating transactions within the system.

Real-Time Settlement: Ripple distinguishes itself by settling transactions in seconds, a significant improvement over traditional international transfers that can take days.

Liquidity and Market Making: Market makers ensure there’s enough XRP available for transactions, even in less common currency pairs.

Decentralized Consensus: Ripple employs the Ripple Protocol Consensus Algorithm (RPCA) for transaction validation, offering speed and energy efficiency.

Interoperability: Ripple is designed to work seamlessly with various fiat currencies and cryptocurrencies.

How Ripple Works

Transaction Initiation: A user sends a payment request through the Ripple network, specifying details like the recipient’s address, amount, and currency.

Consensus Verification: Independent validators reach consensus on transaction validity, checking sender’s XRP holdings and adherence to network rules.

Transaction Execution: Once consensus is reached, the transaction is added to a ledger, becoming final in seconds.

Bridge Currency: XRP acts as a bridge currency for currency exchange in Ripple transactions.

Use Cases of Ripple: Cross-Border Payments: Ripple excels in this area, enabling financial institutions to settle transactions quickly and affordably.

Remittances: Its efficiency makes Ripple attractive for remittance services, reducing fees for individuals sending money abroad.

Liquidity Provision: Market makers profit by providing liquidity in less common currency pairs.

Smart Contracts: Ripple offers smart contract capabilities for programmable financial tools.

Partnerships and Adoption

Ripple has partnered with prominent entities such as American Express, Santander, and MoneyGram, aiming to enhance cross-border payments. However, it faces a legal battle with the SEC regarding XRP’s regulatory status.

Ripple (XRP) Adoption and Technology

Ripple Adoption

Ripple’s journey into the world of finance has been marked by significant strides in adoption, making it a noteworthy player in the industry:

Financial Institutions: Ripple has strategically partnered with numerous financial giants, such as American Express and Santander. These partnerships aim to harness Ripple’s technology to streamline cross-border payments and enhance the efficiency of global financial transactions.

Global Payment Networks: Ripple’s influence extends to global payment networks. Its integration with SWIFT, a major player in financial messaging, underscores Ripple’s commitment to revolutionizing cross-border payments on a grand scale.

Money Transfer Services: Ripple’s appeal has reached money transfer services as well. MoneyGram, a prominent name in the remittance industry, joined forces with Ripple to explore ways to expedite and reduce the costs of cross-border remittances.

Central Banks: Ripple’s expertise in blockchain technology has caught the attention of central banks exploring the possibilities of central bank digital currencies (CBDCs). Ripple has positioned itself as a potential collaborator in CBDC development due to its deep knowledge of blockchain and cross-border payment solutions.

Blockchain Ecosystem: Ripple actively contributes to the broader blockchain ecosystem. It participates in industry consortia and initiatives, advocating for standardization and collaboration among various blockchain projects to promote innovation and growth.

Ripple Technology

Behind Ripple’s achievements lies its cutting-edge technology, composed of several key components:

XRP Ledger: The XRP Ledger serves as the backbone of Ripple’s operations. This decentralized ledger meticulously records all transactions, with its integrity maintained by a network of independent validating servers.

Ripple Consensus Algorithm: Ripple employs a unique consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA). This innovative approach sidesteps the energy-intensive mining processes of proof-of-work (PoW) and the token-staking of proof-of-stake (PoS), resulting in rapid transaction confirmations.

Interledger Protocol (ILP): Ripple actively supports the Interledger Protocol (ILP), an open protocol suite designed to facilitate seamless connections between different payment networks. ILP plays a vital role in Ripple’s mission to promote interoperability between blockchain-based and traditional payment systems.

Smart Contracts: While Ripple’s smart contract capabilities may not be as extensive as some other platforms like Ethereum, they still provide users with the ability to create programmable escrow services and financial instruments. This opens up a range of financial applications.

RippleNet: RippleNet serves as the network hub for financial institutions and service providers utilizing Ripple’s technology for cross-border payments. It establishes the rules, standards, and protocols that govern transactions and ensure compatibility among network participants.

Benefits of Ripple’s Technology

Speed: Ripple’s technology offers real-time settlement of transactions, a stark contrast to the often sluggish pace of traditional banking systems.

Cost-Efficiency: Ripple’s solution is cost-effective, making it a compelling choice for financial institutions and businesses looking to cut down on cross-border payment expenses.

Scalability: Ripple’s architecture is built to handle a high volume of transactions, making it suitable for large-scale payment networks.

Transparency: The transparency of the XRP Ledger empowers users with real-time visibility into transactions, fostering trust within the system.

Challenges and Controversies

Ripple’s journey hasn’t been without hurdles. The legal status of its native cryptocurrency, XRP, has been a point of contention. The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs Inc., alleging that XRP is a security and that Ripple conducted an unregistered securities offering. This ongoing legal battle has significant implications for cryptocurrency regulation in the United States and has affected XRP’s market dynamics.

XRP Technical Analysis

Technical analysis is a methodology employed by traders and investors to make informed decisions about buying or selling assets like cryptocurrencies. When applied to Ripple (XRP), several key factors come into play:

- Price Charts: Technical analysts rely heavily on price charts to study historical price movements. Common chart types for Ripple include candlestick charts, line charts, and bar charts. By examining patterns, trends, and support/resistance levels, analysts aim to predict future price movements.

- Indicators: Various technical indicators are used to gain insights into XRP’s price action. Examples include Moving Averages (MAs), Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence). These indicators provide data on trends, momentum, and potential reversal points.

- Support and Resistance: Identifying support levels (where prices tend to bounce back up) and resistance levels (where prices face selling pressure) is crucial. These levels help traders set entry and exit points and manage risk.

- Trends: Ripple’s price trends can be categorized as bullish (rising), bearish (falling), or ranging (sideways). Technical analysts aim to spot trend reversals or continuations, guiding their trading decisions accordingly.

- Volume Analysis: Trading volume, or the amount of XRP being bought and sold, is a vital component of technical analysis. Changes in volume can indicate the strength or weakness of a trend.

- Chart Patterns: Technical analysts look for chart patterns like head and shoulders, flags, and triangles. These patterns can signal potential price reversals or breakouts.

- Fibonacci Retracement: Fibonacci retracement levels are used to identify potential support or resistance levels based on specific percentages of a prior price move. These levels help traders pinpoint entry and exit points.

- Candlestick Patterns: Candlestick patterns reveal market sentiment within specific timeframes. Patterns like doji, engulfing, and hammer can provide insights into potential price reversals.

- Timeframes: Technical analysts use various timeframes, from minutes to weeks or even months, to assess Ripple’s price action. Short-term traders may focus on hourly charts, while long-term investors may analyze daily or weekly charts.

It’s important to note that technical analysis is not foolproof and does not predict future prices with certainty. It provides valuable insights and helps traders make informed decisions based on historical price data and patterns. However, factors like news events, market sentiment, and fundamental analysis should also be considered when trading Ripple or any other cryptocurrency.

XRP Price Predictions: 2024-2030

Forecasting the price of cryptocurrencies, especially over several years, is an intricate task, as it involves a multitude of dynamic factors. Ripple (XRP), like other digital assets, is subject to a wide array of influences that can sway its value. While it’s impossible to offer precise predictions, we can explore the overarching considerations that may impact Ripple’s price during this timeframe.

- Market Adoption: Ripple’s destiny is closely intertwined with its adoption within the financial sector. Continued collaboration with prominent banks and financial institutions can potentially fuel demand for XRP, contributing to its price growth. The extent to which Ripple’s technology permeates real-world financial use cases will be a key driver.

- Regulatory Landscape: Ripple’s price trajectory will be significantly shaped by regulatory developments. A favorable regulatory environment, marked by clear guidelines and supportive policies, could embolden investors and stimulate price appreciation. Conversely, legal challenges or unfavorable regulations could impede its growth and sentiment.

- Technological Advancements: Ongoing improvements in Ripple’s technology, leading to faster, more efficient, and scalable solutions, may exert a positive influence on its price. Enhanced functionality and expanded use cases can attract a broader user base and investment interest.

- Competition: In a competitive landscape, Ripple faces rivals among other cryptocurrencies and payment solutions. The level of competition and Ripple’s ability to retain or expand its market share will have ramifications for its price. Ongoing monitoring of developments in blockchain and fintech is essential.

- Global Economic Conditions: Cryptocurrency prices, including Ripple’s, can be swayed by macroeconomic events. Economic instability, currency devaluation, or financial crises may encourage investors to seek refuge in cryptocurrencies, potentially driving demand and prices higher.

- Market Sentiment: While long-term forecasts are influenced by fundamentals, short-term price movements are often dictated by investor sentiment. Emotions like FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt) can lead to rapid price fluctuations. Therefore, staying informed about market sentiment is crucial, though long-term investments should be underpinned by fundamental factors.

- Supply and Demand Dynamics: Ripple’s price is inherently linked to supply and demand dynamics. With a fixed supply of XRP, an uptick in demand driven by increased adoption and compelling use cases can exert upward pressure on its price over an extended period.

- Technological Progress: As the broader blockchain ecosystem advances, with innovations such as scalability solutions and improved consensus mechanisms, Ripple must remain adaptable and competitive. Its capacity to evolve within this swiftly changing landscape will impact its long-term price trajectory.

In the ever-evolving world of cryptocurrencies, where unpredictability is the norm, investors and traders should approach price predictions with caution. Conducting thorough research, considering various scenarios, and maintaining a diversified portfolio are prudent strategies to navigate the inherent risks. Additionally, consulting with financial experts and staying attuned to the latest developments in both the cryptocurrency and regulatory spheres is advisable when making investment decisions in this dynamic market.

| Year | Min. Price Prediction | Max. Price Prediction |

| 2024 | $0.8217 | $1.0453 |

| 2025 | $0.9920 | $1.8005 |

| 2026 | $1.3810 | $3.0252 |

| 2027 | $2.0077 | $5.1922 |

| 2028 | $2.6839 | $8.7036 |

| 2029 | $3.4741 | $14.8296 |

| 2030 | $4.9817 | $23.9149 |

XRP Price Prediction 2024

The Ripple predictions for 2024 indicate that the XRP cryptocurrency market is likely to experience a peak value of $1.00852175 and a floor value of $0.63988155. Taking into account the market sentiment and additional XRP price forecasts, it is suggested that the mean price of XRP could potentially reach $0.84790576.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $0.63988155 | $0.65282910 |

| February | $0.64877590 | $0.68481773 |

| March | $0.65772901 | $0.72494804 |

| April | $0.66779226 | $0.75575834 |

| May | $0.67366884 | $0.79483104 |

| June | $0.70007666 | $0.83576484 |

| July | $0.73501048 | $0.86100494 |

| August | $0.75441476 | $0.90414129 |

| September | $0.76995570 | $0.93325464 |

| October | $0.80206285 | $0.97366456 |

| November | $0.81401359 | $1.00852175 |

| December | $0.82166532 | $1.04533280 |

| Price Average | $1.31721523 | $0.84790576 |

XRP Price Prediction 2025

Our Ripple price analysis suggests that the token’s minimum price could be around $0.83283997, while the maximum projected price for XRP stands at $1.80051272. When considering our 2025 XRP price prediction, it hints at the possibility of an average price in the range of $1.12207301.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $0.83283997 | $1.10376690 |

| February | $0.83492207 | $1.16690237 |

| March | $0.85629607 | $1.20494338 |

| April | $0.87616214 | $1.24699591 |

| May | $0.87791446 | $1.30111553 |

| June | $0.88397207 | $1.37671034 |

| July | $0.91066803 | $1.42943835 |

| August | $0.93225086 | $1.47618098 |

| September | $0.97364280 | $1.56371852 |

| October | $0.97422699 | $1.65066127 |

| November | $0.99059400 | $1.70810428 |

| December | $0.99198083 | $1.80051272 |

| Price Average | $0.83750930 | $1.12207301 |

XRP Price Prediction 2026

Based on our Ripple price forecast, it is conceivable that XRP will register an average price of $1.88724008 in the year 2026. The projected price range includes a minimum of $0.99991668 and a maximum of $3.02517433 for Ripple.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $0.99991668 | $1.85758897 |

| February | $1.02361470 | $1.92000396 |

| March | $1.06159081 | $2.01965217 |

| April | $1.08303494 | $2.13840771 |

| May | $1.10697002 | $2.23762983 |

| June | $1.11693275 | $2.32892513 |

| July | $1.16775319 | $2.46050940 |

| August | $1.21820012 | $2.58378092 |

| September | $1.26315171 | $2.68558189 |

| October | $1.31254094 | $2.84295699 |

| November | $1.34272938 | $2.92966718 |

| December | $1.38099717 | $3.02517433 |

| Price Average | $1.03401648 | $1.88724008 |

XRP Price Prediction 2027

As per the Ripple price projection, the coin’s potential peak is $5.19224063, while its potential low point could be $1.42049369. Our Ripple predictions indicate the likelihood of an average price of around $3.19724537 for the year 2027.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $1.42049369 | $3.16191221 |

| February | $1.43753961 | $3.31463256 |

| March | $1.47549066 | $3.49030809 |

| April | $1.54262548 | $3.61805337 |

| May | $1.60972969 | $3.80329770 |

| June | $1.62453920 | $3.99080028 |

| July | $1.70414163 | $4.11930404 |

| August | $1.74129191 | $4.24947405 |

| September | $1.82261025 | $4.44409996 |

| October | $1.88749517 | $4.69430279 |

| November | $1.94430878 | $4.93558996 |

| December | $2.00769324 | $5.19224063 |

| Price Average | $1.41317633 | $3.19724537 |

XRP Price Prediction 2028

According to our Ripple coin price forecast, we anticipate the price of the token to oscillate between $2.05748403 and $8.70356761. Our price predictions further suggest an average price of $5.38686129 for Ripple.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $2.05748403 | $5.35008475 |

| February | $2.10686365 | $5.56194810 |

| March | $2.18481761 | $5.80055568 |

| April | $2.22348888 | $6.04707929 |

| May | $2.24928135 | $6.37422628 |

| June | $2.32035864 | $6.62728307 |

| July | $2.35864456 | $6.87646891 |

| August | $2.43506464 | $7.23542059 |

| September | $2.48352243 | $7.61310954 |

| October | $2.56796219 | $7.96559652 |

| November | $2.64140591 | $8.30493093 |

| December | $2.68393254 | $8.70356761 |

| Price Average | $1.99775848 | $5.38686129 |

XRP Price Prediction 2029

Considering the Ripple predictions and price history, the XRP token is likely to trade at an average price of $9.23030589. The minimum Ripple price is estimated to be $2.73385369, with the maximum Ripple price estimated to reach $14.82964214.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $2.73385369 | $9.18400454 |

| February | $2.84402799 | $9.65789918 |

| March | $2.85796373 | $10.08188095 |

| April | $2.86025010 | $10.44482867 |

| May | $2.91001845 | $10.88768940 |

| June | $3.01448811 | $11.51917539 |

| July | $3.11306187 | $12.14236278 |

| August | $3.17999271 | $12.82962051 |

| September | $3.23564258 | $13.24016836 |

| October | $3.25214435 | $13.72343451 |

| November | $3.33149668 | $14.36980828 |

| December | $3.47408473 | $14.82964214 |

| Price Average | $2.68470440 | $9.23030589 |

XRP Price Prediction 2030

As projected by the 2030 XRP price prediction, it is estimated that the Ripple could reach a minimum price of $3.5018774. The average trading price of Ripple in 2030 is expected to be $15.73352046, and there is the possibility that the Ripple price may reach $23.9149 as its peak.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $3.50187741 | $15.55926053 |

| February | $3.65315852 | $16.06182465 |

| March | $3.76932896 | $16.59025868 |

| April | $3.94611049 | $17.57572004 |

| May | $4.13078846 | $18.45626362 |

| June | $4.22786199 | $19.30525175 |

| July | $4.34962441 | $20.35738797 |

| August | $4.49272705 | $21.41597214 |

| September | $4.53990069 | $22.29616859 |

| October | $4.74919011 | $23.39759932 |

| November | $4.83799996 | $24.71020465 |

| December | $4.98168856 | $23.9149 |

| Price Average | $3.62687944 | $15.73352046 |

XRP Price Prediction: Experts’ Opinion

Nicole Willing: A financial journalist for Capital.com, Nicole Willing highlighted two key events that could potentially impact XRP’s price positively: the completion of XRP co-founder Jed McCaleb’s token sell-off and the outcome of the U.S. Securities and Exchange Commission (SEC) lawsuit against Ripple. She sees these events as potential catalysts for a bullish trend in XRP’s price.

Mitesh Shah: The CEO of Omnia Markets, Mitesh Shah, has a bearish outlook on XRP’s future. He believes that the ongoing lawsuit between Ripple and the SEC could hinder XRP’s growth, regardless of the outcome, particularly impacting U.S. investors’ ability to purchase XRP.

EGRAG CRYPTO: An analyst known as EGRAG CRYPTO on Twitter predicted that XRP might finish 2023 at a price above $0.71. This prediction was made considering the potential ups and downs in the cryptocurrency market.

Dark Defender: Another Twitter analyst, Dark Defender, was more optimistic about XRP’s potential, predicting that it could reach $0.88 by the beginning of December 2023. This forecast was based on their analysis of the market trends and XRP’s performance.

Shannon Thorp: Although not specified in the sources, Shannon Thorp’s name appears in a prediction, suggesting a highly optimistic long-term forecast of $500 for XRP. This ambitious target is based on substantial market capitalization growth.

XRP: A Conclusive Force

In the realm of cryptocurrency investing, predicting the future price of assets like Ripple (XRP) is akin to charting a course through uncharted waters. The crypto market’s innate volatility, influenced by a multitude of intricate factors, makes precise forecasts elusive. However, as we peer into the horizon of Ripple’s price predictions for the years 2024 to 2030, several key takeaways emerge.

First and foremost, Ripple’s journey will be profoundly intertwined with its adoption within the financial sector. The extent to which it continues to forge partnerships with influential banks and financial institutions will be instrumental in shaping its destiny. The integration of Ripple’s technology into tangible, real-world financial applications will be the litmus test for its long-term success.

Equally influential will be the regulatory climate in which Ripple operates. Regulatory clarity and supportive policies can bolster investor confidence, potentially fueling price appreciation. Conversely, the specter of adverse regulations or legal challenges could cast a shadow on Ripple’s growth trajectory.

Technological innovation remains a cornerstone of Ripple’s potential. Enhancements to its technology, leading to quicker, more efficient, and scalable solutions, have the potential to uplift its value proposition. Its adaptability in an evolving landscape, with competitors vying for market share, will be a determinant of its resilience.

Global economic conditions, investor sentiment, and supply and demand dynamics will continue to ebb and flow, affecting Ripple’s price in ways both expected and unforeseen. Emotions like FOMO and FUD will remain ever-present, influencing short-term fluctuations.

In the face of this uncertainty, it is prudent for investors to approach Ripple price predictions with a balanced perspective. Thorough research, diversification of portfolios, and readiness for various scenarios are essential strategies. Furthermore, staying informed about market sentiment and regulatory developments, and seeking guidance from financial experts, are prudent practices in navigating the complex waters of cryptocurrency investments.

As Ripple charts its course through the years 2024 to 2030, one thing is certain: the journey will be marked by twists and turns, but with careful navigation and a steadfast focus on fundamentals, investors can hope to weather the storms and seize the opportunities that may arise along the way.