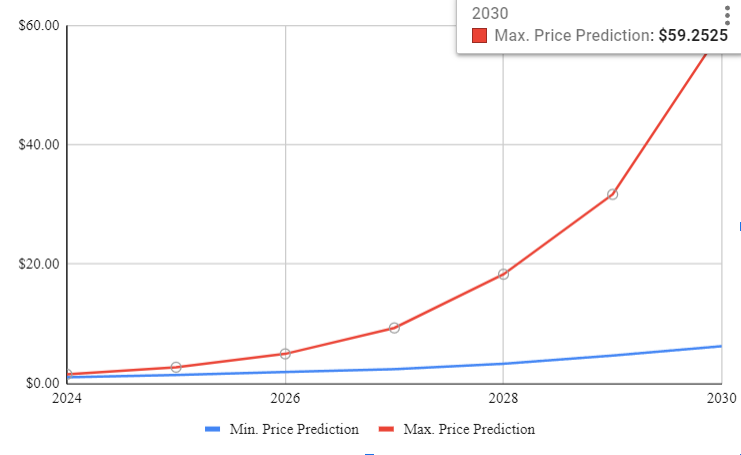

Our prediction for Polygon price

Anticipating the future of Polygon, our experts project a maximum price of 59.25 by 2030. For a comprehensive assessment of your investment returns in Polygon, explore our in-depth material on its price forecast from 2024 to 2030.

What is MATIC crypto?

Polygon, previously known as Matic Network, has emerged as a transformative force within the blockchain space. At its core, Polygon functions as a Layer 2 scaling solution designed to address Ethereum’s scalability challenges while also tackling high gas fees and enabling a broader spectrum of use cases.

Key Highlights

Scalability Revolution: Polygon stands at the forefront of alleviating one of Ethereum’s most pressing dilemmas – scalability. Through its innovative Layer 2 framework, it significantly enhances Ethereum’s transaction processing capacity. This results in faster confirmation times and relief from exorbitant gas fees.

Polygon PoS Chain: Central to Polygon is its proprietary Proof of Stake (PoS) blockchain. This PoS chain empowers developers to create and deploy decentralized applications (DApps) on a secure, high-performance platform.

Interoperability Champion: Polygon champions interoperability within the blockchain sphere. It seamlessly integrates with Ethereum, facilitating the seamless transfer of assets between the two networks. This opens doors to increased accessibility and a wider array of possibilities.

Thriving Ecosystem: Polygon’s ecosystem is experiencing remarkable growth. DApps, projects, and protocols are enthusiastically adopting its infrastructure. This surge in adoption spans diverse sectors, including decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, and more.

Polygon (MATIC) Token: At the heart of the Polygon network lies the MATIC token. This versatile cryptocurrency serves a multitude of functions, including staking for network security, covering transaction fees, and participating in governance decisions.

In summary, Polygon (Matic) plays a pivotal role in not just mitigating Ethereum’s scalability woes but also in cultivating an environment where blockchain applications can flourish. Its Layer 2 solutions empower developers, broaden use cases, and enhance the overall blockchain experience. Polygon is a significant contributor to the evolution of decentralized technologies, poised to make a lasting impact on the industry.

Polygon (MATIC) Adoption and Technology

Polygon (MATIC) has emerged as a beacon of innovation and adoption within the blockchain sphere. Its journey is marked by both technological brilliance and widespread acceptance:

Adoption

Exponential Ecosystem Growth: Polygon has witnessed a meteoric rise in adoption, with a burgeoning ecosystem of projects, DApps, and protocols. This proliferation spans diverse sectors, from DeFi and NFTs to gaming and beyond.

Vital DeFi Presence: Polygon’s impact on the decentralized finance (DeFi) landscape is noteworthy. Its scalability and low transaction costs have made it an attractive platform for DeFi projects, leading to a surge in users and capital locked in Polygon-based DeFi protocols.

NFT and Gaming Dominance: Polygon has also made significant inroads into the world of non-fungible tokens (NFTs) and gaming. NFT marketplaces and blockchain-based games flourish on the network, capitalizing on its efficiency and affordability.

Interoperability: Polygon’s commitment to interoperability stands out. Its seamless integration with Ethereum and compatibility with various blockchain networks positions it as a bridge between ecosystems, fostering broader adoption.

Global Reach: Polygon’s adoption transcends geographical boundaries, boasting a global community of users, developers, and enthusiasts. Its inclusive ethos aligns with the blockchain’s mission to provide equitable access to decentralized technologies.

Technology

Layer 2 Solutions: At the heart of Polygon’s technological prowess lies its Layer 2 scaling solutions. These solutions enable high-speed, low-cost transactions while maintaining the security of the Ethereum mainnet.

Polygon PoS Chain: The Polygon PoS (Proof of Stake) chain represents a significant technological leap. It empowers developers to build and deploy DApps within a secure, efficient blockchain environment.

Interoperability Framework: Polygon’s interoperability framework facilitates seamless asset transfers between different blockchain networks, eliminating silos and enhancing the overall blockchain ecosystem.

Polygon (MATIC) Token: MATIC, Polygon’s native cryptocurrency, plays a vital role in the network’s operations. It functions as a utility token for staking, transaction fees, and governance decisions.

In essence, Polygon (MATIC) has achieved remarkable adoption by addressing scalability issues and offering a versatile platform for developers and users alike. Its commitment to technological innovation and interoperability has positioned it as a transformative force in the blockchain landscape, with the potential to drive mass adoption of decentralized technologies.

MATIC Technical Analysis

Analyzing the technical aspects of Polygon (MATIC) involves a meticulous examination of historical price data, coupled with the utilization of various technical indicators and chart patterns to discern potential price movements. While this analysis offers insights, it’s vital to remember that it’s not a crystal ball but a tool for informed decision-making.

Key Aspects of Polygon Technical Analysis

Price Charts: The foundation of MATIC’s technical analysis lies in price charts, which can be represented in candlestick, line, or bar forms. Analysts assess these charts to identify patterns, trends, and potential price levels.

Indicators: Technical indicators like Moving Averages (MAs), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) offer insights into MATIC’s trends, momentum, and potential reversals.

Support and Resistance: Traders often seek crucial support and resistance levels. Support represents price levels where buying interest tends to emerge, while resistance signifies levels where selling pressure becomes prominent.

Trends: Analysts classify MATIC’s price trends as bullish (upward), bearish (downward), or ranging (sideways). Recognizing these trends is pivotal for strategic decisions, such as entering (going long) or exiting (going short) positions.

Volume Analysis: Trading volume, indicating the amount of MATIC traded, holds significant importance. Sudden surges or drops in volume can signal potential trend reversals or validate existing trends.

Chart Patterns: Technical analysts look for chart patterns like head and shoulders, triangles, flags, and more. These patterns may suggest potential price reversals or breakouts, offering valuable insights.

Fibonacci Retracement: Fibonacci retracement levels help identify potential support or resistance levels based on specific percentages of prior price moves. Traders use these levels for pinpointing entry and exit points.

Candlestick Patterns: Candlestick patterns provide insights into market sentiment within specific timeframes. Recognizable patterns like doji, engulfing, and hammer can offer clues about potential price reversals.

Timeframes: Technical analysis can be conducted across various timeframes, from minutes to weeks or months. Short-term traders often focus on hourly charts, while long-term investors prefer daily or weekly charts.

External Factors: MATIC’s technical analysis should consider external factors like news events, regulatory developments, and market sentiment, which can significantly impact price dynamics.

In conclusion, technical analysis of MATIC equips traders and investors with tools to comprehend its price behavior. However, it’s crucial to complement technical analysis with fundamental research and a comprehensive understanding of the broader cryptocurrency market for well-informed decisions in the dynamic world of MATIC trading and investment.

MATIC Price Predictions: 2024-2030

Predicting Polygon’s (MATIC) price in the ever-evolving crypto market is challenging. Factors like growing adoption, DeFi prominence, technological upgrades, and market sentiment will influence its trajectory. While short-term volatility may persist, MATIC’s long-term potential depends on continued ecosystem expansion, interoperability advancements, and regulatory developments. Supply and demand dynamics will play a pivotal role, with increasing adoption potentially driving prices. However, it’s essential for investors to stay informed, diversify portfolios, and maintain a long-term perspective when considering MATIC for investment. The crypto journey promises opportunities, but prudent navigation is key.

| Year | Min. Price Prediction | Max. Price Prediction |

| 2024 | $1.0699 | $1.4929 |

| 2025 | $1.4290 | $2.6310 |

| 2026 | $1.9642 | $4.8851 |

| 2027 | $2.6889 | $9.0638 |

| 2028 | $3.6346 | $16.4645 |

| 2029 | $4.7721 | $30.4315 |

| 2030 | $6.6398 | $54.3078 |

MATIC Price Prediction 2024

The Polygon projections for 2024 suggest that the MATIC cryptocurrency market will witness a peak value of $1.4929 and a bottom value of $0.8427. Considering the market sentiment and further MATIC price analysis, it is implied that the mean price of MATIC might be $1.1613.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $0.8427 | $0.8747 |

| February | $0.8443 | $0.9278 |

| March | $0.8579 | $0.9592 |

| April | $0.8667 | $1.0097 |

| May | $0.8873 | $1.0746 |

| June | $0.9021 | $1.1081 |

| July | $0.9392 | $1.1613 |

| August | $0.9602 | $1.2369 |

| September | $0.9905 | $1.3017 |

| October | $1.0215 | $1.3570 |

| November | $1.0413 | $1.4322 |

| December | $1.0699 | $1.4929 |

| Price Average | $1.7591 | $1.1613 |

MATIC Price Prediction 2025

Our Polygon price analysis leads us to consider a minimum price of approximately $1.1224 for the token, alongside the potential for MATIC to reach a maximum value of $2.6310. When looking at our 2025 MATIC price forecast, it indicates the likelihood of an average price around $1.5969.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $1.1224 | $1.5589 |

| February | $1.1426 | $1.6425 |

| March | $1.1686 | $1.7427 |

| April | $1.1740 | $1.8230 |

| May | $1.1770 | $1.9462 |

| June | $1.1996 | $2.0056 |

| July | $1.2301 | $2.1089 |

| August | $1.2571 | $2.2093 |

| September | $1.3110 | $2.2983 |

| October | $1.3659 | $2.3845 |

| November | $1.4229 | $2.4753 |

| December | $1.4290 | $2.6310 |

| Price Average | $1.1193 | $1.5969 |

MATIC Price Prediction 2026

Our Polygon price forecast implies that MATIC might hover around an average price of $2.8161 in 2026. Additionally, the projected price range encompasses a minimum of $1.4353 and a maximum of $4.8851 for Polygon.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $1.4353 | $2.7650 |

| February | $1.5062 | $2.9068 |

| March | $1.5392 | $2.9978 |

| April | $1.5956 | $3.1929 |

| May | $1.6443 | $3.3053 |

| June | $1.6997 | $3.5109 |

| July | $1.7397 | $3.6166 |

| August | $1.7713 | $3.8329 |

| September | $1.8020 | $4.0560 |

| October | $1.8748 | $4.3107 |

| November | $1.9333 | $4.5982 |

| December | $1.9642 | $4.8851 |

| Price Average | $1.4650 | $2.8161 |

MATIC Price Prediction 2027

Based on the Polygon price projection, it’s possible that the coin may reach a maximum of $9.0638, and simultaneously, it could see a decline to $1.9707. Our Polygon predictions for 2027 hint at an average price of approximately $5.2115.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $1.9707 | $5.2188 |

| February | $1.9859 | $5.4635 |

| March | $1.9914 | $5.8105 |

| April | $2.0223 | $6.1202 |

| May | $2.1151 | $6.4078 |

| June | $2.1792 | $6.6141 |

| July | $2.2716 | $6.8807 |

| August | $2.3536 | $7.3520 |

| September | $2.3536 | $7.8373 |

| October | $2.4536 | $8.1939 |

| November | $2.5670 | $8.5298 |

| December | $2.6889 | $9.0638 |

| Price Average | $1.9569 | $5.2115 |

MATIC Price Prediction 2028

According to our Polygon coin price forecast, the token’s price is forecasted to move within the range of $2.7126 and $16.4645. Our price predictions also highlight an average price of $9.5943 for Polygon.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $2.7126 | $9.3919 |

| February | $2.7994 | $10.0127 |

| March | $2.8089 | $10.5714 |

| April | $2.8392 | $10.9012 |

| May | $2.9795 | $11.4583 |

| June | $3.1124 | $12.0931 |

| July | $3.1395 | $12.5707 |

| August | $3.2911 | $13.1452 |

| September | $3.3296 | $14.0417 |

| October | $3.4541 | $14.9741 |

| November | $3.5933 | $15.5281 |

| December | $3.6346 | $16.4645 |

| Price Average | $2.6642 | $9.5943 |

MATIC Price Prediction 2029

Based on Polygon predictions and price history, the MATIC token is likely to trade at an average price of $17.4287. The minimum Polygon price is estimated to be $3.7070, while the maximum Polygon price is estimated to reach $30.4315.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $3.7070 | $17.2021 |

| February | $3.7211 | $17.8902 |

| March | $3.8141 | $18.9278 |

| April | $3.8927 | $19.5581 |

| May | $3.9787 | $20.6201 |

| June | $4.0603 | $21.9233 |

| July | $4.1277 | $23.3571 |

| August | $4.3142 | $24.2983 |

| September | $4.4320 | $25.1415 |

| October | $4.4994 | $26.8788 |

| November | $4.5448 | $28.7415 |

| December | $4.7721 | $30.4315 |

| Price Average | $3.6089 | $17.4287 |

MATIC Price Prediction 2030

As projected by the 2030 MATIC price prediction, the Polygon is expected to reach a minimum price estimate of $4.8021. The average trading price of Polygon in 2030 is $32.5594, and there is the possibility that the Polygon price may achieve $54.3078 as its highest point.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $4.8021 | $32.4917 |

| February | $4.8948 | $34.3990 |

| March | $5.1082 | $36.1843 |

| April | $5.2982 | $38.2902 |

| May | $5.3311 | $40.4115 |

| June | $5.5454 | $42.7230 |

| July | $5.8166 | $44.8720 |

| August | $5.9916 | $46.9226 |

| September | $6.2715 | $48.4054 |

| October | $6.3561 | $50.3851 |

| November | $6.3606 | $52.1940 |

| December | $6.6398 | $54.3078 |

| Price Average | $4.8755 | $32.5594 |

MATIC Price Prediction: Experts’ Opinion

Margex.com provides an analysis that considers various factors affecting Polygon’s price potential. They note that the demand for cryptocurrencies, the utility and use case, and strategic partnerships are significant drivers of price growth. As of their latest analysis, they observed that the cryptocurrency markets are in a bearish cycle, which may affect the price growth potential of Polygon (MATIC). However, they also note that a positive reversal in the market could see Polygon recover in price accordingly.

Anton Kharitonov, an analyst at Traders Union, predicts that the price of Polygon will reach $0.933 by the end of 2024. Their analysis expects moderate growth of the Polygon coin price, with MATIC potentially reaching a range of $0.8397 – $1.0263 by the end of 2024. They also provide detailed month-by-month predictions for 2024.

TheNewsCrypto presents technical analysis indicators and trend patterns to predict Polygon’s price. They note that if the current trend continues, MATIC might reach resistance levels of $0.8787, and $1.3669. Conversely, if the trend reverses, MATIC may fall to support levels of $0.6019, and $0.5057. Their bullish price prediction for Polygon (MATIC) in 2023 is $1.5660, while the bearish prediction is $0.4480. They also provide predictions for the years up to 2030, suggesting that MATIC could reach as high as $15 by 2030.

Final Words

Polygon’s (MATIC) price prediction journey encapsulates the dynamic nature of the crypto market. While forecasts are challenging, key factors like adoption, DeFi prominence, and technology upgrades offer optimism. However, volatility remains a constant companion. Long-term MATIC potential hinges on ecosystem growth, interoperability strides, and regulatory developments. As adoption increases, supply and demand dynamics may favor price appreciation. Yet, wise investors embrace diversification and maintain vigilance. The crypto realm teems with promise, but sound judgment and a steadfast outlook are essential when exploring Polygon’s role in your investment strategy.