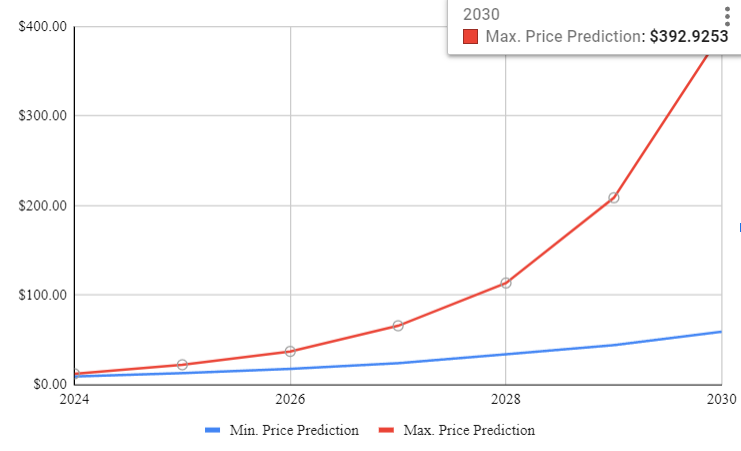

Our prediction for Polkadot price

The expert consensus is that Polkadot will potentially reach a peak price of $392.92 by 2030. To evaluate the profitability of your investment in Polkadot, we have provided a detailed overview of its price forecasts from 2024 to 2030.

What is DOT crypto?

Polkadot (DOT) is a groundbreaking blockchain platform founded by Dr. Gavin Wood, one of Ethereum’s co-founders. Its core mission is to establish a multichain ecosystem where diverse blockchains seamlessly interconnect and cooperate. Polkadot achieves this through several key features.

At the heart of Polkadot lies the relay chain, serving as the network’s foundation. It orchestrates communication and consensus among the parachains, which are individual blockchains that connect to the relay chain. These parachains can be tailored for specific use cases, offering developers a platform for specialized applications without the need to create a new blockchain from scratch.

Polkadot’s defining characteristic is interoperability. It encourages parachains to share data, assets, and functionality, fostering innovation and flexibility across the network. Additionally, DOT, Polkadot’s native cryptocurrency, plays a vital role in governance. DOT holders actively participate in decision-making processes, such as proposing and voting on network upgrades and parameter adjustments.

Polkadot places a strong emphasis on security, employing advanced mechanisms like Nominated Proof-of-Stake (NPoS) to ensure network reliability. Its multichain structure enhances scalability by enabling the addition of new parachains as required, accommodating increased network activity.

The platform finds application in various sectors, notably in decentralized finance (DeFi), where its interoperable environment facilitates cross-chain asset transfers and collaboration. It also simplifies asset transfers between blockchains, reduces friction and cost, and empowers developers to create specialized parachains tailored to specific applications. Furthermore, Polkadot’s multichain framework offers unique possibilities for the NFT ecosystem, enabling interconnected NFTs across different blockchains.

Polkadot (DOT) Adoption and Technology

Polkadot (DOT) has carved a significant presence in the blockchain space, marked by both its growing adoption and technological innovation.

Adoption

Polkadot’s adoption journey reveals its appeal across various sectors:

Interoperability Solution: Polkadot’s reputation as a robust interoperability solution has attracted developers and businesses seeking to bridge different blockchains. This adoption extends to projects in DeFi, supply chain, and beyond.

NFT Ecosystem: Polkadot’s multichain architecture offers an enticing environment for the NFT ecosystem, with NFT marketplaces and applications finding a home within its framework.

Cross-Chain Asset Transfers: The platform’s ability to simplify cross-chain asset transfers has earned the attention of cryptocurrency enthusiasts and businesses looking for seamless asset interoperability.

Technology

Polkadot’s technological advancements underpin its adoption:

Relay Chain and Parachains: The relay chain’s role as the network’s backbone ensures secure communication among parachains. Parachains, customizable blockchains, enhance Polkadot’s versatility.

Interoperability Framework: Polkadot’s core strength lies in its ability to foster interoperability among parachains, facilitating data, asset, and functionality sharing.

Governance Mechanism: The native cryptocurrency, DOT, drives governance within the platform, empowering DOT holders to influence decision-making processes and network upgrades.

Security Measures: Polkadot prioritizes security, implementing innovative mechanisms like Nominated Proof-of-Stake (NPoS) to maintain network integrity.

Scalability: Polkadot’s scalable architecture accommodates the addition of new parachains, ensuring the network can handle increasing demand.

In conclusion, Polkadot’s adoption and technological advancement are intertwined, with its interoperability solutions finding favor across industries. Its multichain framework, governance, security, and scalability make it a fertile ground for blockchain innovation, promising a dynamic future in the blockchain landscape.

DOT Technical Analysis

Analyzing the technical aspects of Polkadot (DOT) involves a meticulous examination of historical price data and the application of various technical indicators to identify potential trends and trading opportunities. Here’s a closer look at key aspects of DOT’s technical analysis:

Price Charts: The foundation of DOT’s technical analysis lies in price charts, which are represented in various formats, including candlestick, line, or bar charts. These charts provide a visual representation of historical price movements and patterns.

Moving Averages (MAs): Traders frequently employ moving averages, such as the 50-day and 200-day MAs, to gauge DOT’s trend direction. Crossovers and divergences in these moving averages can signal potential trend changes.

Relative Strength Index (RSI): RSI is a crucial indicator for determining whether DOT is overbought or oversold. Values above 70 may suggest overbought conditions, while values below 30 may indicate oversold conditions.

MACD (Moving Average Convergence Divergence): The MACD is another popular momentum indicator, consisting of two lines. Crossovers between these lines serve as potential buy or sell signals, indicating shifts in momentum.

Support and Resistance Levels: Traders pay close attention to key support levels (where buying interest strengthens) and resistance levels (where selling pressure intensifies). These levels help identify potential price reversal points.

Chart Patterns: Recognizable chart patterns, such as triangles, head and shoulders, and flags, can offer insights into DOT’s potential future price movements.

Trading Volume: Volume analysis is essential for confirming price trends. Sudden spikes or drops in trading volume may indicate trend reversals or validate existing trends.

Fibonacci Retracement Levels: Traders use Fibonacci retracement levels to identify potential support or resistance levels based on specific percentages of prior price moves.

Candlestick Patterns: Candlestick patterns, like doji, hammer, or engulfing, provide insights into market sentiment within specific timeframes.

Timeframes: Technical analysis can be conducted across various timeframes, from minutes to weeks or months. Short-term traders often focus on hourly charts, while long-term investors prefer daily or weekly charts.

It’s crucial to remember that while technical analysis provides valuable insights, it’s not infallible. Combining technical analysis with fundamental research and a comprehensive understanding of the broader cryptocurrency market can lead to more informed trading and investment decisions in the dynamic world of DOT.

DOT Price Predictions: 2024-2030

| Year | Min. Price Prediction | Max. Price Prediction |

| 2024 | $8.8766 | $11.9125 |

| 2025 | $12.6416 | $22.0021 |

| 2026 | $17.4187 | $36.9285 |

| 2027 | $23.7607 | $65.6037 |

| 2028 | $33.7244 | $113.4441 |

| 2029 | $43.9518 | $208.7540 |

| 2030 | $58.9782 | $392.9253 |

Predicting the price of Polkadot (DOT) between 2024 and 2030 involves considering a multitude of dynamic factors that could potentially shape its trajectory during this period. First and foremost, the extent of Polkadot’s adoption across various industries will be a pivotal factor influencing its price. If Polkadot continues to be embraced by sectors like decentralized finance (DeFi), non-fungible tokens (NFTs), and cross-chain applications, this increased adoption could drive up demand for the platform’s services and contribute positively to its overall value.

Additionally, Polkadot’s role as a leading interoperability solution within the blockchain space will significantly impact its adoption and, subsequently, its price. Its unique position as a platform that facilitates seamless communication and collaboration among diverse blockchains may continue to attract both users and assets, further bolstering its market value.

Technological advancements will also play a crucial role in determining Polkadot’s future price. Ongoing improvements in the platform’s technology, including enhancements in scalability and security, can enhance its attractiveness to users and developers alike. As the blockchain landscape evolves, Polkadot’s ability to adapt and innovate will be a key factor in its price performance.

However, it’s important to acknowledge that regulatory developments will remain a significant point of consideration. The regulatory environment surrounding cryptocurrencies can greatly influence investor sentiment and confidence. Clear and favorable regulations can provide a boost to Polkadot’s price, while unfavorable regulations may pose challenges and uncertainties.

In the world of cryptocurrencies, market sentiment is a dominant force, capable of driving both bullish and bearish trends in the short term. Investor sentiment can be influenced by a multitude of factors, including news events, social media, and economic indicators. As such, it will continue to be a vital element shaping Polkadot’s price movements in the years ahead.

Competition within the blockchain space is another factor that Polkadot must contend with. As other blockchain platforms and interoperability solutions emerge, Polkadot’s ability to differentiate itself and offer unique advantages will be critical in maintaining its market position and, consequently, its price stability.

Furthermore, global economic conditions and events can have a profound impact on cryptocurrency prices. Economic instability or crises may drive investors toward cryptocurrencies as alternative assets, potentially benefiting Polkadot and contributing to its price growth.

Last but not least, supply and demand dynamics will play a pivotal role in determining Polkadot’s price trajectory. With its scalable architecture, Polkadot is well-positioned to accommodate increased demand. Consequently, as demand for its services and assets rises, it may exert upward pressure on its price.

In summary, predicting the price of Polkadot (DOT) from 2024 to 2030 remains an exercise in uncertainty, as it hinges on numerous interconnected factors. These elements provide a comprehensive framework for assessing Polkadot’s potential price movements during this period. As investors navigate the dynamic cryptocurrency market, maintaining a long-term perspective, staying informed, and adopting a diversified portfolio strategy will be essential to making well-informed decisions regarding Polkadot and its role in their investment strategies.

DOT Price Prediction 2024

The Polkadot predictions for 2024 anticipate that the DOT cryptocurrency market will experience a peak value of {price-max} and a floor value of {price-min}. Analyzing the market sentiment and additional DOT price forecasts, it becomes apparent that the mean price of DOT might hover around {price-average}.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $6.9686 | $6.8844 |

| February | $7.0313 | $7.2865 |

| March | $7.0348 | $7.7849 |

| April | $7.0826 | $8.2667 |

| May | $7.1825 | $8.5156 |

| June | $7.3412 | $8.9430 |

| July | $7.6672 | $9.5029 |

| August | $7.7331 | $9.8858 |

| September | $8.0889 | $10.2368 |

| October | $8.3121 | $10.9411 |

| November | $8.7103 | $11.4312 |

| December | $8.8766 | $11.9125 |

| Price Average | $15.3359 | $9.2993 |

DOT Price Prediction 2025

Based on our Polkadot price prediction, the potential minimum price for the token may be approximately {price-min}, while the maximum projected price for DOT is {price-max}. Our outlook for DOT in 2025 suggests an average price of around {price-average}.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $9.2219 | $12.6439 |

| February | $9.3188 | $13.1800 |

| March | $9.4865 | $14.0525 |

| April | $9.7863 | $14.9632 |

| May | $10.1601 | $15.4270 |

| June | $10.5980 | $15.9901 |

| July | $10.6637 | $16.8775 |

| August | $10.8375 | $17.9375 |

| September | $11.3079 | $18.9886 |

| October | $11.8224 | $19.8355 |

| November | $12.3237 | $20.8630 |

| December | $12.6416 | $22.0021 |

| Price Average | $9.4213 | $12.9461 |

DOT Price Prediction 2026

In our Polkadot price forecast, we anticipate an average price of {price-average} for DOT in 2026. The price range projection suggests a minimum of {price-min} and a maximum of {price-max} for Polkadot.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $12.8515 | $22.8338 |

| February | $13.3115 | $24.2563 |

| March | $13.7202 | $25.3745 |

| April | $14.2965 | $26.3134 |

| May | $14.4123 | $27.4869 |

| June | $14.7798 | $28.5809 |

| July | $15.4729 | $29.8385 |

| August | $15.5720 | $31.4766 |

| September | $16.0812 | $32.7766 |

| October | $16.5668 | $34.2909 |

| November | $17.0704 | $35.6694 |

| December | $17.4187 | $36.9285 |

| Price Average | $12.7657 | $22.8613 |

DOT Price Prediction 2027

According to our Polkadot price forecast, the coin may touch the high of {price-max}, while on the downside, it might fall to {price-min}. As per our Polkadot predictions, the token’s price might be trading at an average of around {price-average} in 2027.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $17.6382 | $38.3318 |

| February | $18.2167 | $40.4554 |

| March | $18.7796 | $42.6319 |

| April | $19.4125 | $44.5546 |

| May | $19.5153 | $47.4462 |

| June | $20.1730 | $50.7105 |

| July | $20.8428 | $53.6669 |

| August | $21.4639 | $55.3359 |

| September | $22.1400 | $57.5659 |

| October | $22.4787 | $59.5232 |

| November | $23.4813 | $62.8208 |

| December | $23.7607 | $65.6037 |

| Price Average | $17.6889 | $39.8934 |

DOT Price Prediction 2028

As per our Polkadot coin price forecast, the token’s price range is expected to extend from {price-min} to {price-max}. Our price predictions also indicate an average price of {price-average} for Polkadot.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $24.7800 | $70.1960 |

| February | $25.2657 | $73.5935 |

| March | $25.4830 | $76.1619 |

| April | $26.0742 | $79.4597 |

| May | $26.6140 | $82.1137 |

| June | $27.9074 | $85.4393 |

| July | $28.9260 | $88.3100 |

| August | $29.8025 | $93.0523 |

| September | $30.5654 | $97.7979 |

| October | $32.0356 | $103.1377 |

| November | $32.4617 | $109.8520 |

| December | $33.7244 | $113.4441 |

| Price Average | $24.3693 | $69.2439 |

DOT Price Prediction 2029

Considering Polkadot predictions and price history, it is anticipated that the DOT token will trade at an average price of {price-average}. The minimum Polkadot price is projected to be {price-min}, and the maximum Polkadot price is estimated to reach {price-max}.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $34.2607 | $117.5848 |

| February | $34.3497 | $122.7468 |

| March | $35.2669 | $128.0740 |

| April | $35.9969 | $135.0669 |

| May | $36.5513 | $143.3735 |

| June | $36.9497 | $151.5744 |

| July | $37.3894 | $160.9114 |

| August | $38.5783 | $169.4397 |

| September | $38.8137 | $181.0633 |

| October | $40.6573 | $191.3296 |

| November | $42.5601 | $201.9484 |

| December | $43.9518 | $208.7540 |

| Price Average | $32.9334 | $122.1468 |

DOT Price Prediction 2030

As per the 2030 price prediction for DOT, the Polkadot is estimated to have a minimum price of {price-min}. The anticipated average trading price of Polkadot in 2030 is {price-average}, and there is the potential for the Polkadot price to reach {price-max} as its highest value.

| Month | Min. Price Prediction | Max. Price Prediction |

| January | $46.0879 | $220.5487 |

| February | $47.4567 | $231.8187 |

| March | $48.6289 | $247.6287 |

| April | $50.6421 | $261.4216 |

| May | $52.6931 | $275.3293 |

| June | $53.0092 | $294.2444 |

| July | $53.7832 | $313.1349 |

| August | $54.7298 | $324.6582 |

| September | $55.7806 | $335.7616 |

| October | $56.2603 | $355.8401 |

| November | $57.1605 | $368.0454 |

| December | $58.9782 | $392.9253 |

| Price Average | $44.9388 | $226.2148 |

DOT Price Prediction: Experts’ Opinion

Changelly provides a short-term price prediction for Polkadot. They suggest that DOT might see a price change in the coming days, indicating a moderately bullish outlook for the short term.

BeInCrypto offers a more detailed analysis, noting a potential bullish price move for DOT in the short term based on the volatility chart and trading volume. They suggest that DOT could make new highs soon, based on a bullish RSI divergence observed on the weekly chart. Their prediction for DOT in 2023 is around $9.82, and for 2025, it could reach as high as $41.71. By 2030, they foresee the price potentially soaring to around $213.27, indicating a very bullish long-term outlook.

The Tech Report provides a yearly breakdown of potential highs and lows for Polkadot from 2023 to 2030. They predict that DOT could reach a high of $6.9 and a low of $4 by the end of 2023. For 2024, the high could be around $16 and the low around $6.2. Moving forward, they suggest that by 2025, DOT could peak at $44 and reach a low of $23.3. Their long-term prediction for 2030 estimates a high of $85 and a low of $55.

Final words

Predicting Polkadot’s (DOT) price from 2024 to 2030 is a complex task influenced by various dynamic factors. Its value hinges on factors like adoption across industries, technological advancements, regulatory developments, market sentiment, competition, global economic conditions, and supply-demand dynamics.

The adoption of Polkadot in sectors like DeFi, NFTs, and cross-chain applications could drive demand and enhance its value. Its role as an interoperability solution and its technological innovation make it an attractive platform, but regulatory considerations remain pivotal.

Market sentiment will continue to exert short-term influence, while competition and global economic events will play significant roles. Supply and demand dynamics, aided by its scalable architecture, will also shape its price.

In conclusion, while precise predictions are challenging, understanding these factors provides a framework for assessing Polkadot’s potential price trends. Investors should maintain a long-term perspective, stay informed, and diversify their portfolios to navigate the dynamic crypto market successfully.