What is Crypto Swing Trading? Top Swing Trading Strategies

Crypto swing trading is a popular trading strategy in the volatile cryptocurrency market, designed to capture gains from price movements over a period of days or weeks. This approach sits between day trading and long-term investing, allowing traders to take advantage of market oscillations while avoiding the stress of constant market monitoring. Swing traders in the crypto space aim to identify potential price swings using various technical analysis tools, fundamental analysis, and market sentiment indicators.

Understanding Crypto Swing Trading

Swing trading in cryptocurrencies involves:

- Holding positions for several days to a few weeks;

- Capitalizing on expected upward or downward market “swings”;

- Using technical analysis to identify entry and exit points;

- Managing risk through proper position sizing and stop-loss orders;

- Balancing potential rewards with the inherent volatility of crypto markets.

This strategy appeals to traders who seek to profit from short to medium-term price movements without the need for constant market attention. It allows for a more balanced approach to trading, particularly suitable for those who cannot dedicate full-time hours to market analysis and execution.

Key Characteristics of Crypto Swing Trading

Several factors distinguish swing trading from other trading strategies in the cryptocurrency market:

- Time frame: Typically ranges from a few days to several weeks;

- Analysis focus: Combines technical analysis with fundamental factors;

- Trade frequency: Lower than day trading but higher than long-term investing;

- Risk management: Crucial due to overnight and weekend exposure;

- Capital requirements: Generally lower than day trading due to reduced trade frequency.

These characteristics make swing trading an attractive option for traders looking to balance potentially higher returns with a manageable time commitment and risk profile.

Top Swing Trading Strategies for Cryptocurrencies

Several strategies have proven effective for crypto swing traders:

1. Trend-Following Strategy

This approach involves:

- Identifying the overall market trend using longer-term moving averages;

- Entering positions in the direction of the trend during pullbacks;

- Setting stop-loss orders below key support levels;

- Taking profits at predetermined resistance levels or when momentum wanes.

Trend-following strategies capitalize on the tendency of crypto markets to exhibit strong, prolonged trends. Traders using this approach aim to catch significant portions of these trends while managing risk during countertrend movements.

2. Counter-Trend Strategy

Counter-trend swing trading focuses on:

- Identifying overbought or oversold conditions using oscillators like RSI or Stochastic;

- Entering trades against the prevailing trend when momentum shows signs of weakening;

- Setting tight stop-loss orders to manage risk in case the main trend resumes;

- Taking profits quickly as counter-trend moves tend to be shorter and more volatile.

This strategy requires careful risk management but can be highly profitable when executed correctly, especially in ranging market conditions.

3. Breakout Trading

Breakout swing trading involves:

- Identifying key support and resistance levels on charts;

- Entering trades when price breaks above resistance or below support with increased volume;

- Setting stop-loss orders just beyond the breakout point;

- Taking profits at predetermined price targets or when momentum slows.

Breakout strategies aim to capture strong moves that occur when a cryptocurrency’s price breaks out of an established trading range. These moves can be particularly powerful in the crypto market due to the high levels of speculation and FOMO (Fear of Missing Out) often present.

4. Moving Average Crossover Strategy

This popular strategy involves:

- Using two or more moving averages of different time periods;

- Entering long positions when a shorter-term MA crosses above a longer-term MA;

- Entering short positions when a shorter-term MA crosses below a longer-term MA;

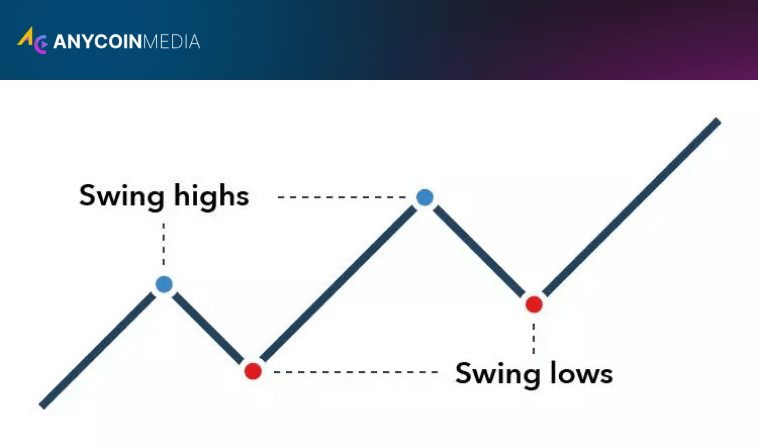

- Setting stop-loss orders based on recent swing highs or lows;

- Taking profits when the MAs show signs of converging again.

Moving average crossovers provide a systematic approach to identifying potential trend changes, making them popular among both novice and experienced swing traders.

5. Support and Resistance Trading

This strategy focuses on:

- Identifying key support and resistance levels using historical price data and technical indicators;

- Entering long positions near strong support levels when price shows signs of bouncing;

- Entering short positions near strong resistance levels when price struggles to break through;

- Setting stop-loss orders beyond the support or resistance level;

- Taking profits at the next significant support or resistance level.

Support and resistance trading capitalizes on the tendency of crypto prices to respect historical price levels, often bouncing off or struggling to break through these key areas.

Successful swing trading in cryptocurrencies often relies on a combination of technical analysis tools and indicators:

- Candlestick charts for identifying price patterns;

- Moving averages (simple and exponential) for trend identification;

- Relative Strength Index (RSI) for overbought/oversold conditions;

- Fibonacci retracement levels for potential support and resistance;

- Volume indicators to confirm price movements;

- Bollinger Bands for volatility and potential reversal points.

These tools, when used in combination, provide swing traders with a comprehensive view of market conditions, helping to inform entry and exit decisions.

Risk Management in Crypto Swing Trading

Effective risk management is crucial in crypto swing trading due to the market’s high volatility. Key risk management practices include:

- Setting appropriate position sizes (typically 1-2% of trading capital per trade);

- Using stop-loss orders to limit potential losses;

- Implementing a consistent risk-reward ratio (e.g., risking 1% to potentially gain 3%);

- Diversifying trades across different cryptocurrencies and trading pairs;

- Avoiding overleverage, which can lead to rapid account depletion.

Adhering to strict risk management principles helps swing traders survive the inevitable losing streaks and capitalize on winning trades when they occur.

Advantages of Crypto Swing Trading

Swing trading in the cryptocurrency market offers several advantages:

- Less time-intensive than day trading;

- Potential for capturing larger price movements compared to day trading;

- Reduced trading costs due to lower trade frequency;

- Ability to use higher time frame charts, which can be less noisy;

- Opportunity to capitalize on both bullish and bearish market conditions;

- Flexibility to hold positions over weekends when significant price moves often occur.

These advantages make swing trading an attractive option for traders looking to balance their trading activities with other commitments while still aiming for substantial returns.

Challenges in Crypto Swing Trading

Despite its advantages, crypto swing trading comes with its own set of challenges:

- Exposure to overnight and weekend price gaps;

- Need for larger stop-losses to accommodate crypto volatility;

- Potential for missing out on prolonged trends;

- Difficulty in timing entries and exits in a highly volatile market;

- Impact of sudden news events or regulatory changes on open positions;

- Psychological challenges of holding positions through price swings.

Successful crypto swing traders must develop strategies to mitigate these challenges and maintain a disciplined approach to their trading.

Importance of Fundamental Analysis in Crypto Swing Trading

While technical analysis forms the backbone of many swing trading strategies, fundamental analysis plays a crucial role in the crypto market:

- Monitoring project developments and roadmap progress;

- Tracking adoption metrics and network activity;

- Staying informed about regulatory developments;

- Analyzing token economics and supply dynamics;

- Evaluating partnerships and institutional involvement.

Incorporating fundamental analysis helps swing traders validate their technical setups and avoid potential pitfalls caused by significant project-specific or market-wide events.

Adapting Swing Trading Strategies to Market Conditions

The cryptocurrency market undergoes periods of varying volatility and trend strength. Successful swing traders adapt their strategies to prevailing market conditions:

- In trending markets: Focus on trend-following strategies;

- In ranging markets: Emphasize support and resistance trading;

- During high volatility: Adjust position sizes and widen stop-losses;

- In low volatility periods: Look for breakout opportunities;

- During major market events: Reduce exposure or sit on the sidelines.

Flexibility and the ability to adapt to changing market dynamics are key attributes of successful crypto swing traders.

Crypto swing trading offers a balanced approach to capitalizing on the volatile nature of cryptocurrency markets. By focusing on medium-term price movements, swing traders aim to capture significant gains while managing the risks inherent in the crypto space. The diverse range of strategies available, from trend-following to counter-trend approaches, allows traders to adapt their tactics to various market conditions and personal preferences.

As the crypto ecosystem continues to evolve, swing traders must stay informed about both technical developments and fundamental factors affecting their chosen assets. By combining robust technical analysis with awareness of market fundamentals and a disciplined approach to risk management, crypto swing traders can position themselves to potentially profit from the dynamic and often lucrative world of digital assets.